All About Amur Capital Management Corporation

A P/E proportion of 15, for example, tells us that investors agree to pay $15 for every $1 of profits business earns over one year. The P/E ratio is the most typically made use of measure of a supply's relative worth. A high P/E proportion suggests that financiers have greater expectations for a firm.

A low P/E ratio may suggest that a company is undervalued, or that investors expect the business to face much more hard times in advance. Financiers can utilize the ordinary P/E proportion of various other firms in the exact same industry to form a baseline.

Some Ideas on Amur Capital Management Corporation You Should Know

The standard in the auto and vehicle industry is just 15. A supply's P/E proportion is simple to locate on most financial reporting web sites. This number suggests the volatility of a stock in contrast to the market in its entirety. A protection with a beta of 1 will certainly show volatility that's the same to that of the market.

A supply with a beta of over 1 is in theory much more unpredictable than the marketplace. As an example, a protection with a beta of 1.3 is 30% more volatile than the marketplace. If the S&P 500 rises 5%, a supply with a beta of 1. https://www.kickstarter.com/profile/amurcapitalmc/about.3 can be anticipated to rise by 8%

An Unbiased View of Amur Capital Management Corporation

EPS is a dollar number standing for the part of a firm's revenues, after taxes and participating preferred stock rewards, that is assigned to every share of ordinary shares. Financiers can utilize this number to determine exactly how well a business can supply value to investors. A greater EPS begets greater share prices.

If a company frequently falls short to supply on revenues projections, a financier may wish to reconsider purchasing the supply - mortgage investment. The estimation is straightforward. If a company has a take-home pay of $40 million and pays $4 million in dividends, after that the continuing to be sum of $36 million is split by the variety of shares superior

3 Simple Techniques For Amur Capital Management Corporation

Investors frequently get thinking about a stock after checking out headings concerning its phenomenal efficiency. Just keep in mind, that's yesterday's news. Or, as the investing pamphlets constantly expression it, "Previous efficiency is not a forecaster of future returns." Sound investing choices must think about context. A look at the fad in rates over the previous 52 weeks at the least is required to obtain a sense of where a stock's cost may go next.

Allow's consider what these terms indicate, exactly how they vary and which one is ideal for the average investor. Technical analysts brush with massive quantities of information in an initiative to forecast the instructions of supply costs. The information is composed mainly of previous pricing info and trading quantity. Essential evaluation fits the demands of the majority of financiers and has the advantage of making great feeling in the real world.

They think rates comply with a pattern, and if they can understand the pattern they can maximize it with well-timed trades. In recent years, innovation has actually allowed more financiers to practice this style of investing since the tools and the information are a lot more available than ever before. Essential experts think about the innate value of a stock.

The Facts About Amur Capital Management Corporation Uncovered

A lot of the ideas reviewed throughout this item are common in the essential expert's world. Technical evaluation is best matched to a person that has the moment and comfort level with information to place endless numbers to make use of. Otherwise, essential evaluation will fit the requirements of many capitalists, and it has the benefit of making great feeling in the real life.

Broker agent charges and shared fund expenditure ratios pull cash from your profile. Those expenses cost you today and in the future. As an example, over a duration of 20 years, annual fees of 0.50% on a $100,000 financial investment will decrease the profile's worth by $10,000. Over the same period, a 1% cost will reduce the same portfolio by $30,000.

The find more pattern is with you. Many common fund companies and online brokers are lowering their charges in order to complete for clients. Make use of the pattern and store around for the cheapest price.

Fascination About Amur Capital Management Corporation

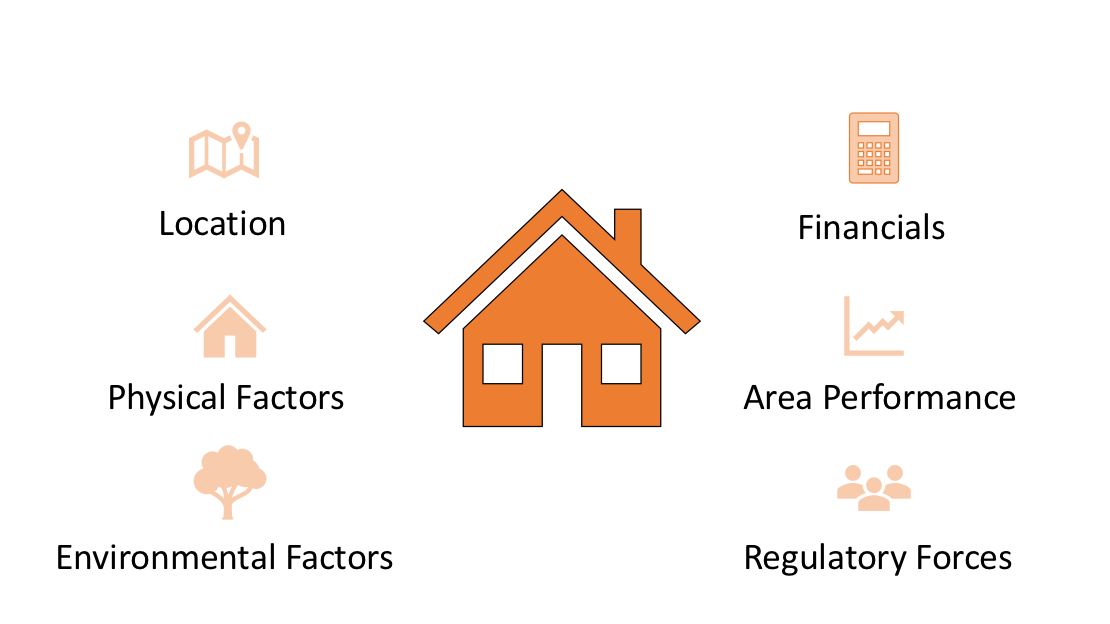

, green space, picturesque sights, and the community's status variable prominently right into domestic building assessments. A key when taking into consideration residential property place is the mid-to-long-term sight concerning exactly how the area is expected to advance over the financial investment duration.

The Buzz on Amur Capital Management Corporation

Completely review the possession and designated use of the immediate areas where you prepare to spend. One way to gather info about the potential customers of the location of the residential or commercial property you are taking into consideration is to get in touch with the city center or various other public firms in charge of zoning and metropolitan planning.

Residential or commercial property valuation is necessary for financing throughout the purchase, detailing rate, financial investment analysis, insurance policy, and taxationthey all rely on property evaluation. Generally made use of genuine estate appraisal techniques consist of: Sales comparison technique: current similar sales of residential properties with comparable characteristicsmost typical and appropriate for both new and old residential properties Expense method: the price of the land and building and construction, minus devaluation appropriate for brand-new construction Revenue technique: based upon anticipated cash money inflowssuitable for services Provided the reduced liquidity and high-value financial investment in genuine estate, an absence of quality purposefully might bring about unanticipated outcomes, including monetary distressspecifically if the financial investment is mortgaged. This supplies routine revenue and long-lasting value appreciation. This is usually for quick, small to tool profitthe regular home is under building and offered at an earnings on completion.

Comments on “Amur Capital Management Corporation Things To Know Before You Get This”